For contracts or transfers dated on or after 1 July 2017, this information is obtained via the digital duties form. Please refer to the Settlement Statement under question – Concessions/Exemptions - Pensioner Concession.

A Pensioner Concession/Exemption application must include SRO Form 8F (last modified 1 May 2013) as part of the supporting documentation for the transfer.

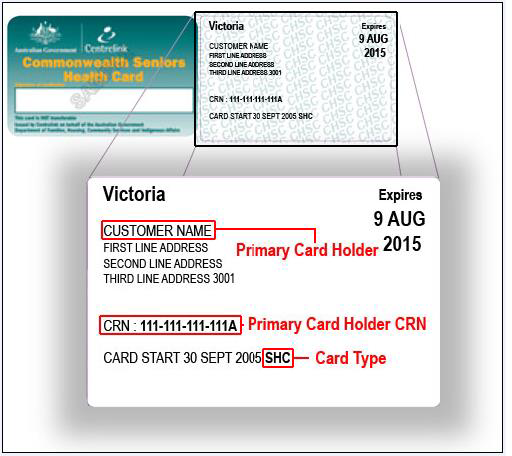

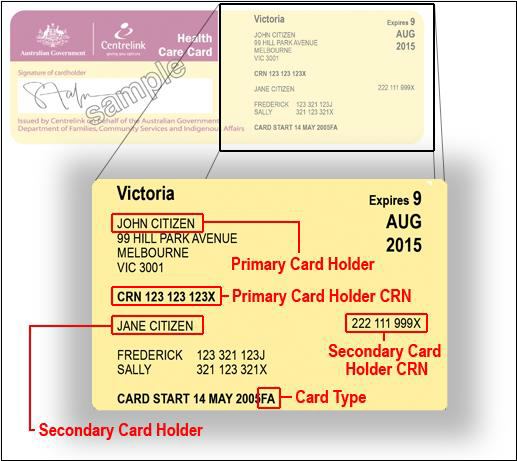

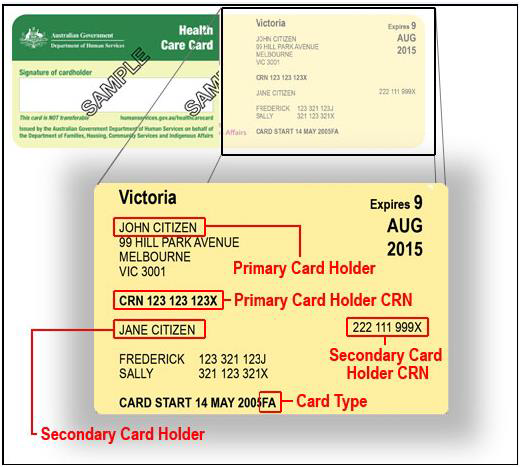

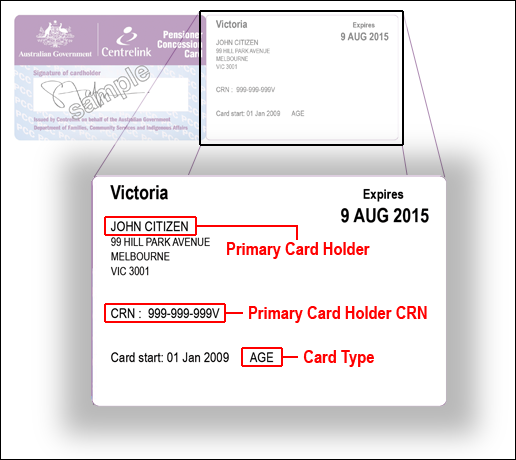

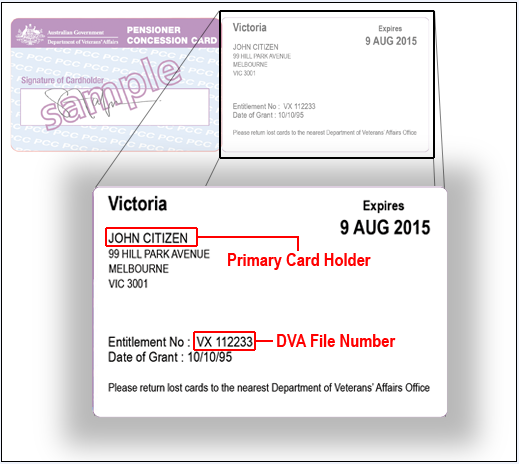

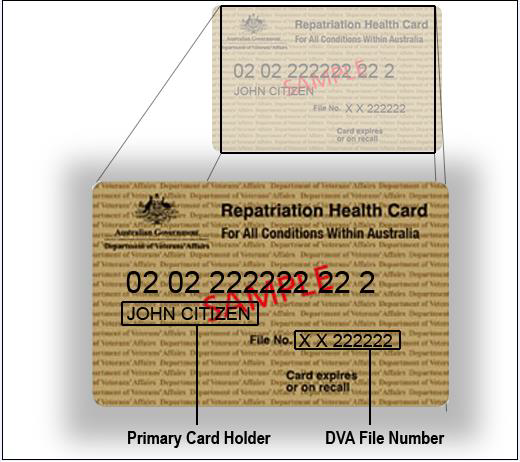

Department of Human Services and Department of Veterans Affairs card types contain certain elements that must be entered into the Duties Online transaction. The Department of Veterans Affairs card must be a Victorian card starting with the letters VS.

Each applicant must be a cardholder in their own right to receive the pensioner exemption or concession. If only one applicant holds a valid card, then the exemption or concession will only apply to the interest passing to that applicant. Duty for the other (non-pensioner) purchaser(s) will be assessed according to the percentage of their interest in the property. The exception to this is cards relating to Family Allowance or Parenting Payment - refer to section on Secondary Card Holder. Duties Online will only allow the processing of two applicants per transaction.

Note: If the transferee(s) indicate that they are foreign, they will not qualify for a Pensioner Concession.

A Pensioner Concession cannot be claimed in Duties Online if there are more than two transferee(s) subject to the transfer.This will need to be electronically lodged via a State Revenue Office (SRO) Duty Determination.

The following diagrams contain information on where to find the fields required for the Duties Online pensioner transaction.