Where the contract price does not include GST because no GST is payable on the transfer, the answer to the question 'Does the consideration amount stated in the contract include any amount for GST?' should be 'No'.

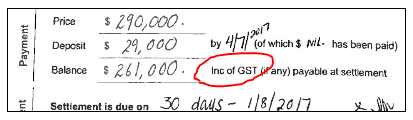

The Particulars of Sale in a contract will specify whether the price (or balance) includes GST (if any).

Most contract prices are inclusive of GST.

In this scenario, the consideration amount stated in the contract includes GST (if any).

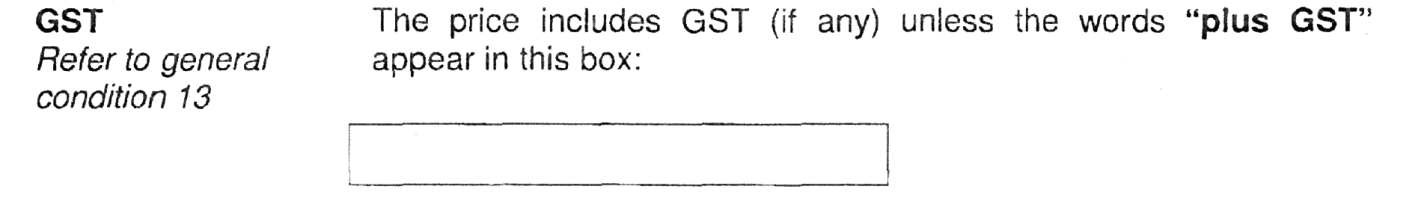

Some contracts may also state:

In this scenario, if the text box is empty, then the amount stated in the contract includes GST (if any) and if the text box states ‘Plus GST’, the amount stated in the contract does not include GST.

Some contracts may also state:

If the words 'Farming Business' or 'Going Concern' appear in the text box, then the amount stated in the contract does not include GST, and the transferor does not make a taxable supply under the contract for the purposes of GST.